Brazoria Appraisal Districts Raises Commercial Values 1.8% In 2021

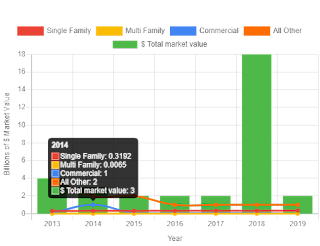

Most property owners believe appraisal districts should cut taxable values in 2021. 93% of Texas property owners surveyed by O’Connor thought appraisal districts should reduce values in 2021 due to the impact of COVID. Brazoria Appraisal District raised the overall taxable value of commercial properties by 1.8%, for the 9,893 commercial properties with 2021 values available. The 2021 increase in Brazoria Appraisal District taxable values is summarized below: Office 7.65% Retail 2.04% Warehouse 4.24% Apartment 14.85% Taxable values were increased for 353 of 581 office buildings. The total assessed value increased to $0.56 billion in 2021 from $0.51 billion in 2020. The increases are surprising considering the i...